Getting My Paul B Insurance Local Medicare Agent Melville To Work

You can confirm business as well as representative licenses by calling our Assistance Line at 800-252-3439 Attempt to buy from a representative you understand and also trust. These might help you later on if there is a dispute over what you were informed concerning a plan.

Get the names and also addresses of the agent and also the insurer. Know how to speak to the representative as well as the company with questions. Answer all concerns on the application precisely. If a representative assists you complete the application, see to it the details is right and full prior to you sign. Do not pay cash or make a check out to an agent.

What Does Paul B Insurance Medicare Part D Melville Mean?

If you purchase a policy as well as pay a year's worth of costs up front, then terminate your plan a month later, the business would owe you 11 months of your premium - paul b insurance Medicare Advantage Agent melville. Review your plan thoroughly when you get it. You can return a Medicare supplement plan for any reason within thirty day and also obtain a complete reimbursement.

Selling you a Medicare supplement policy that replicates Medicare advantages or wellness insurance policy protection you currently have. A representative is needed to assess and also compare your various other wellness protections.

Paul B Insurance Medicare Agency Melville for Beginners

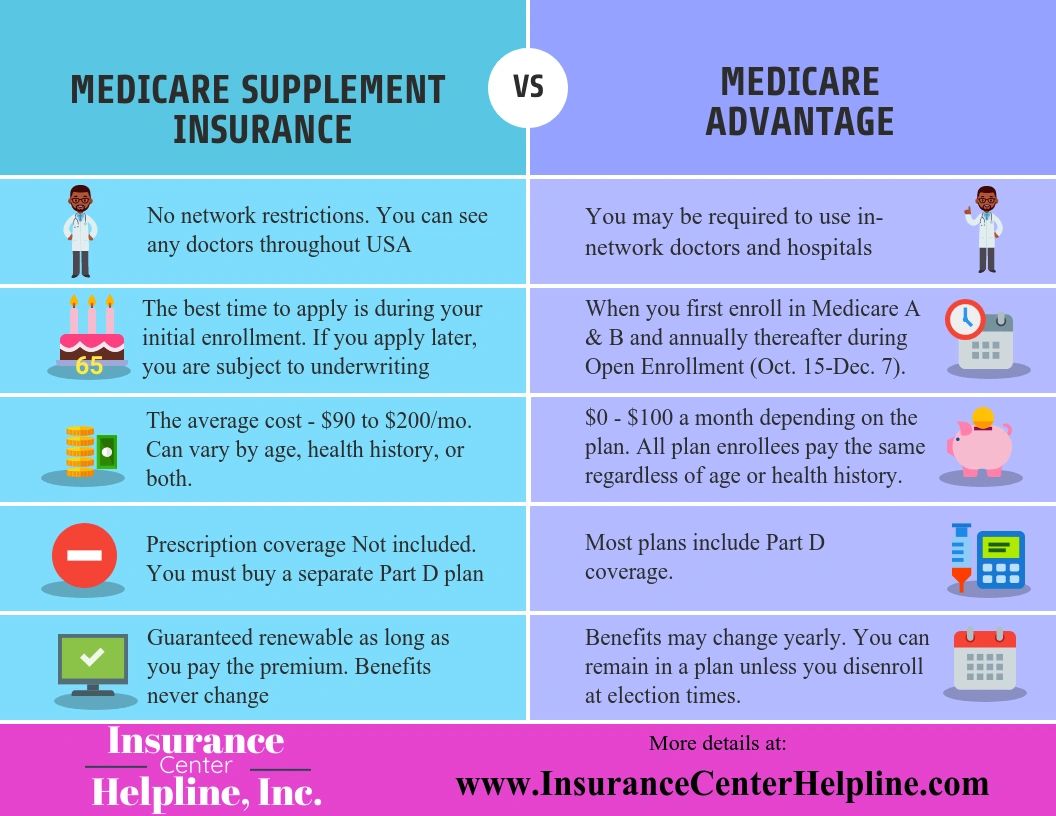

Recipients weigh several compromises. On the one hand, Medicare Benefit intends typically give some protection for advantages not included in traditional Medicare, such as spectacles. Plans additionally have a cap on out-of-pocket expenditures for solutions covered by standard Medicare, while typical Medicare does not have a similar restriction. On the various other hand, traditional Medicare permits recipients to visit any medical professional, health center, or other wellness treatment company that approves Medicare, without the need for prior authorization; Medicare Advantage enrollees commonly need a reference from their health care medical professional as well as plan approval if they desire solutions from professionals, such as oncologists, covered by the plan.

This analysis concentrates on 1,605 participants age 65 and also older who were signed up in Medicare. To read more regarding our study, consisting of the modified sampling method, see "Just how We Performed This Survey.".

If you wait to sign up the month of your birthday or the 3 months that follow, you will have to wait 1 to 3 months for coverage to start. Various other enrollment periods. If you did not enroll in Components An and B throughout the first registration period, you might do so in between Jan.

Paul B Insurance Medicare Advantage Agent Melville for Beginners

Medicare Prescription Drug Plans (Component D). paul b insurance medicare health advantage melville. You might join, switch over, or go down a medicine strategy between Oct. 15 and Dec. 7. There is an exemption: You may sign up with a 5-star Medicare Prescription Medicine Plan, as rated by Medicare, from Dec. 8th to Nov. 30th, however you can only do this once.

8 Simple Techniques For Paul B Insurance Local Medicare Agent Melville

You will certainly not sustain fines if you don't, but without Medicare Component B protection, you could be without coverage for outpatient services. If you have retiree health insurance coverage with your or your spouse's previous company, you likely still wish to register for Medicare. Several senior citizen health insurance plan work as a "wrap-around" covering the voids in Medicare coverage.

This out-of-pocket limitation just uses to services that would otherwise have been covered by Original Medicare, so it does not consist of prescription medicine prices, which Original Medicare does not cover.

See This Report about Paul B Insurance Local Medicare Agent Melville

PFFS strategies in some cases cover prescriptions, however if you have one that doesn't, you can supplement it with a Medicare Component D plan. MSAs do not consist of prescription insurance coverage, however you can get a Part D plan to supplement your MSA strategy. Even though Benefit enrollees have rights and also securities under Medicare standards, the services offered and the costs billed by exclusive insurance providers vary extensively.

Benefit strategies can charge monthly premiums in enhancement to the Part B premium, although 66% of 2023 Medicare Benefit intends with integrated Component D insurance coverage are "absolutely no costs" strategies. This means that beneficiaries just pay the Part B costs (as well as potentially much less than the complete Part B costs, if they choose a strategy with the giveback refund advantage explained listed below).

Yet across all Medicare Benefit strategies, the average premium is about $18/month for 2023. This typical consists of zero-premium plans and Medicare Advantage plans that don't consist of Part D insurance coverage if we only take a look at strategies that do have premiums and also that do include Component D protection, the typical costs is greater.

The Only Guide to Paul B Insurance Medicare Supplement Agent Melville

(Recipients should remember that the out-of-pocket cap only applies to solutions that would otherwise be covered by Medicare Components An and also B although many Benefit strategies include Component D insurance coverage, drug prices are not topped and also are not consisted of in the maximum out-of-pocket restrictions. Drug expenses will certainly be capped starting in 2024, as a result of the Inflation Decrease Act.) But numerous plans have out-of-pocket restrictions below this threshold, so it is essential to take into consideration the optimum out-of-pocket when comparing policies.

S. regions (most Advantage plans do not include rebates for Component B premiums, however the majority of locations do contend the very least one plan that does). As of 2023, nearly 17% of Medicare Benefit intends include at the very least some reduction in the Part straight from the source B costs, although it's crucial to keep in mind that this can vary from as low as ten cents to as much as the full Part B premium, so the benefit varies considerably throughout the strategies that use this.

Because instance, the giveback rebate will certainly be credited to the Social Safety check to offset the amount that's subtracted for Part B. some Medicare beneficiaries pay for their Component B protection directly. If those beneficiaries register in an Advantage strategy that has a giveback refund, the quantity of the refund will be shown on the Part B billing that they obtain.

Not known Details About Paul B Insurance Medicare Advantage Plans Melville

If you have actually been on the Medicare Advantage plan for more than a year, there is no requirement that Medigap intends be assured issue for people switching back from Medicare Benefit to Original Medicare. So if you have actually obtained health problems, it may be costly or impossible to get an additional Medigap strategy (some states have guidelines that make it less complicated for people to enroll in Medigap strategies after their preliminary enrollment home window and/or test best period have ended; click your state on this map to see exactly how Medigap new car insurance plans are managed).

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)

:max_bytes(150000):strip_icc()/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)